How High Can Gold Rise?

Gold is rising amid a weakening dollar and languishing cryptocurrencies as weaknesses in these asset classes are causing institutions and small investors alike to back off. What’s going on with gold and all the different methods for investors to gain exposure (bullion, ETF trusts, mining stocks)? And can it be believed? While several dynamics could indicate a perfect storm for exposure to gold prices, there have been a number of “head-fakes” over the past few years that have disappointed investors. Let’s look at what has been driving the recent upward march in the metal, which is still considered a store of value.

What’s Going On?

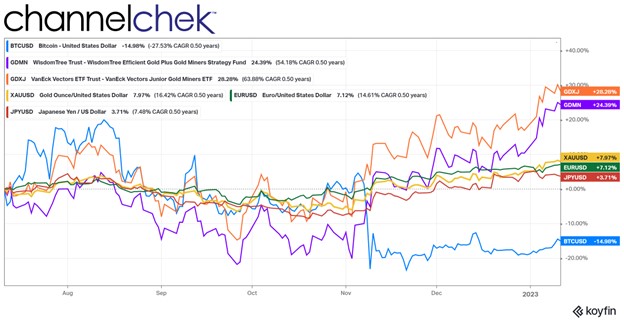

Gold futures touched an eight-month high on Wednesday, January 11 (Six-month chart below). The US dollar (shown here vs Yen and Euro) has been losing its strength in response to central bank hawkishness overseas coupled with a sizable decline in US bond yields.

The ramp up of China’s economy after a long period of Covid-related restrictions is pushing precious and industrial metal prices higher as demand is expected to escalate. Copper is also benefiting as futures contracts for this highly conductive metal reached its highest level since June.

The concerns over the global economy in 2023 also have some wealth managers allocating a larger portion to gold and silver for “investment insurance”. Gold historically has a low correlation to stock prices. Investors who were relying on a 60/40 (stocks & bonds) allocation to hedge each other against one asset class tumbling found they could have benefited from further diversification

Outlook (Bullion/Miners)

In a survey conducted before Christmas, BullionVault users forecast a gold price of $2,012.60 for the end of 2023, with nearly 38% of the 1,829 full responses pointing to the need to spread risk and diversify portfolios as the top reason for investing in bullion.

In his quarterly report on metals and mining, the Noble Capital Markets senior equity analyst, Mark Reichaman shared an outlook that sounded positive but cautious on precious metals miners. “We think precious metals prices around current levels are sufficient for mining companies to be profitable and attract new investment. Our outlook is for range-bound pricing around current levels with a modest upward bias in the first half of 2023, said Reichamn who focuses on materials and mining.

Take Away

A dollar trending upward attracts assets from across the globe. The long trend seems to have broken which has left higher demand for gold and gold mining investments. Also feeding into the demand is China reopening manufacturing that had been shuttered.

The crypto crash and current uncertainty have had the affect of causing investors in these alternative assets to move to other investments.

There has been a move by investors looking for alternative allocations to more traditional stock and bond holdings, including registered investment advisors (RIA). The 60/40 portfolio took a huge hit last year, an allocation to less correlated gold and gold stocks may be deemed prudent by those not looking to repeat.

Paul Hoffman

Managing Editor, Channelchek

Sources

https://www.bullionvault.com/gold-price-chart.do

https://www.channelchek.com/news-channel/metals-mining-fourth-quarter-2022-review-and-outlook

https://www.investopedia.com/terms/u/usdx.asp

https://www.barrons.com/articles/gold-price-rally-51672870199