Meme Stocks are Putting Up a Strong Offense – Is this a Positive Sign for the Broader Market?

During the first three weeks of 2023, meme stocks and crypto tokens, often viewed in the same category, have scored early. Have meme stock investors now come off the sidelines after the poor performance last year? In 2022 they completely failed to repeat their historic 2021 wins. So the current rally is a great sign.

Successful meme trading occurs when there is a mass movement by retail accounts. So far in 2023, like flipping a New Year’s switch, retail is again causing a commotion. And by looking at the trending hashtags and cashtags on Reddit and Twitter, fans are also making an increased volume of noise.

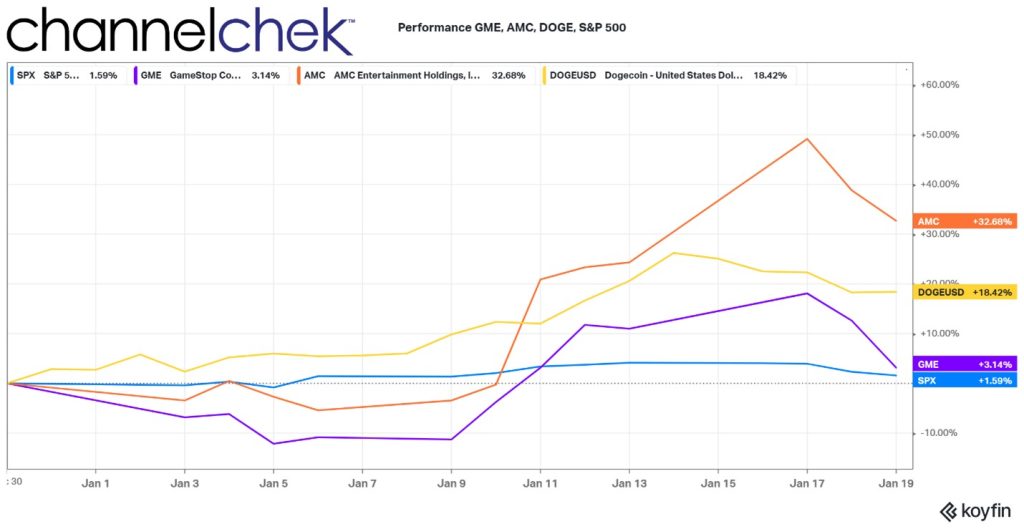

Looking at the 2023 performance chart above, the S&P 500 ($SPY) opened the year more positively than the prior year ended. While one obviously can not extrapolate out the current 1.59% return for the year, annualizing it helps bring the short period being measured into perspective. The overall market is running at a 30.50% pace this year. Wow.

The performance of GameStop ($GME), which was one of the original and among the most recognized meme stocks, is outperforming the overall market by double. While it is well off its high reached earlier this week, the above 3% return is running well ahead of the overall stock market.

The cryptocurrency in the group, the often maligned Dogecoin (DOGE.X), which is legendary as it started as a parody token, has been tracking Bitcoins (BTC.X) rise closely. DOGE is up over 18% on the year, averaging an increase near 1% per day.

AMC Entertainment ($AMC), which is off its high of almost 50% a few days ago, now has returned over 32% to those holding the stock. To put this in perspective, it has an annualized return in 2023, so far, of 628%. This likely has gotten ahead of itself, time will tell, but it is the clear MVP among the meme stocks to date.

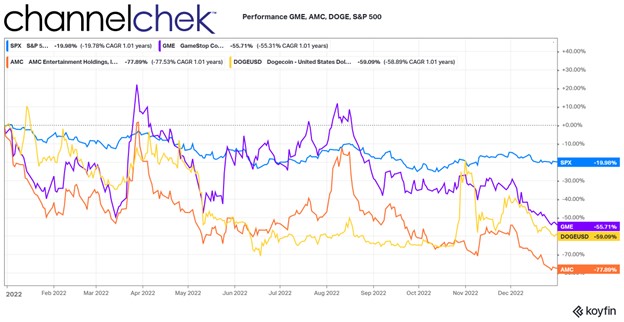

Last year the overall market, despite being down near 20%,, trounced the meme stocks that have thus far put in a stellar showing in 2023.

Is Meme Rally a Reason for Optimism?

Retail dollars coming in off the sidelines and mounting enough of a drive to force values up so quickly indicates a mood change that may play out elsewhere in the financial markets. The average trade size of retail is so small that it indicates a large wave of willingness, if not outright optimism, that putting money in play will lead to gains. Similar forces are causing money to move into mutual funds and ETFs, which serves to put upward pressure on the overall market.

Wall Street’s so-called “fear gauge,” the Volatility Index ($VIX) dropped on average 1% a day since the start of the year. This is a spectacular trend. It now stands near its long-term average of 21; a reading above 30 is considered bearish. The $VIX was last near these levels in April of last year. The overall market stood 15% higher back then compared to today.

The Volatility Index has applications across digital assets as well. On a scale of 1-100, where 100 is overly greedy, The Crypto Fear and Greed Index stands near neutral at 52. This is also the most optimistic reading since April. It may be considered even more positive since the digital asset market is still digesting the “unprecedented” bankruptcy of crypto exchange FTX.

Meme mania has never been about macro; more about crowd behavior, commitment, and momentum. But there are fundamentals that are viewed by stock investors of all varieties that likely have fed into the burst of interest. First, economic data suggests that inflation is trending lower. This deceleration lessens the need for the Federal Reserve to put the brakes on the economy. The enthusiasm is just more pronounced among this style of retail traders that are loud and proud. They serve as cheerleaders to captivate the imagination of more traditional investors.

Take Away

The overall financial markets opened with a sigh of relief in 2023. Meme stocks and crypto opened the year with extreme optimism. The optimism isn’t without cause; a number of factors point to a much better environment than the dismal returns of last year.

Will this contagion, led by many small accounts, inspire further the larger individual and institutional investors to commit investments in the broader markets, there are many signs that suggest the year is starting that way, fear of missing out will build with each day that the markets move in a positive direction.

Paul Hoffman

Managing Editor, Channelchek