FOMC Meeting and “Wall Street Wish List” May Impact Your Portfolio Most

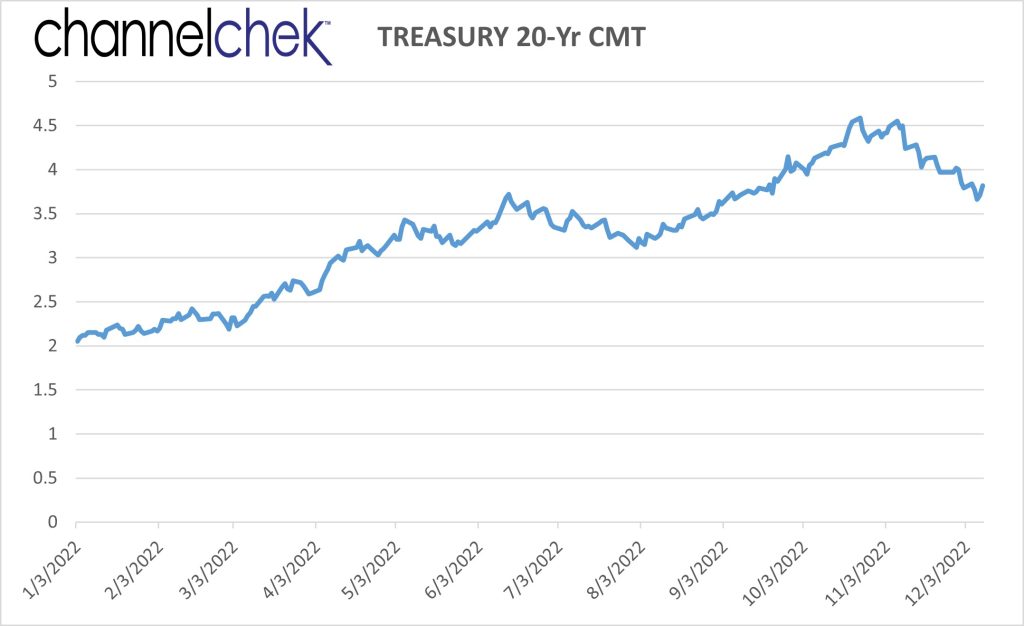

Is the Fed really tightening lending rates to cool the economy? Because consumer rates have been headed lower since October. This last FOMC meeting of 2022 may help the markets to understand that something has to give. A 7.7% y-o-y CPI, a 3.75-4.00% Fed Funds target, and a 3.45% 20-year constant maturity treasury can not co-exist for long. Treasury investors either need to earn more to keep up with expected inflation realities, inflation needs to show a more certain downtrend or the Fed needs to go back to lowering Fed Funds levels. Having lived through the last three years of markets, which I can attest from experience, are very different from the previous 30 years, I’m still putting my money on what the Fed Chairman tells us he’s doing. However, markets being what they are will move with the moves of the masses, and that is what’s “right” because that is what makes money.

The December FOMC meeting is front and center this week. We also get a new CPI report pre-meeting. Expect volatility, especially with longer-term treasuries already priced for a great CPI number.

Monday 12/12

- 2:00 PM ET, Treasury Statement, forecasters see a $200.0 billion deficit in November that would compare with a $191.3 billion deficit in November a year ago and a deficit in October this year of $87.8 billion. The government’s fiscal year began in October. The size of the budget deficit is important because it impacts the amount of treasury issuance, and then supply and demand take over in terms of interest rates demanded to fill the supply.

Tuesday 12/13

- 6:00 AM ET, Optimism is expected to remain low. The small business optimism index has been below the historical average of 98 for ten months in a row and deeply so in October at 91.3. November’s consensus is 90.8.

- 8:30 AM ET, CPI for November is the first information with potential market-altering data to be released this week. It will be the last look at CPI for a month during 2022. CPI is expected to be 0,% for the month or 7.3% y-o-y. Do you remember how the market rallied on the better than the consensus 7.7% last month? Any deviation from the consensus could cause an impact.

Wednesday 12/14

- 8:30 AM ET, Atlanta Fed Business Inflation Expectations for December. While we have no consensus data, The Atlanta Fed’s Business Inflation Expectations survey came in last month at 3.3% expected. The survey number provides a monthly measure of year-ahead inflation expectations and inflation uncertainty from the perspective of firms. The survey also provides a monthly gauge of firms’ current sales, profit margins, and unit cost changes.

- 2:00 PM ET, FOMC Announcement, let the trading week unofficially begin as markets shuffle with new information from the 2:00 PM announcement and press conference that follows. After a series of 75 bp moves, the Fed is expected to be less aggressive with a 50 bp increase.

Thursday 12/15

- 8:30 AM ET, Jobless Claims for the December 10 week are expected to come in at 230,000, or unchanged from the prior week. A large deviation from this number could move markets as employment is a Fed mandate.

- 9:00 AM ET, Wall Street Wish List. Seasoned Analysts from Noble Capital Market’s veteran team discuss the sectors and companies they cover and perhaps provide actionable ideas as to where they may lean in the year ahead. Information for free online event is here.

Friday 12/16

- 9:45 AM ET, PMI Composite Flash. At 46.2 in November, the services PMI has been sinking deeper into contraction though expectations for December’s flash is a little slower pace of contraction at 46.5. Manufacturing, at 47.7 in November, is expected little changed at 47.8.

What Else

The weekly focus is on the FOMC decision and press conference. Register for Channelchek emails and receive our synopsis of the FOMC outcome immediately post announcement.

It may turn out that the Wall Street Wish List is the most profitable sharing of ideas that you receive headed into the new year. Don’t miss this by clicking on the banner below to allow you free access.

Managing Editor, Channelchek

Sources