Stock Market Performance – Looking Back at February, Forward to March

The months seem to go by quickly. And as satisfying as January was for most stock market investors, February left people with 2022 flashbacks. High inflation, or what more inflation could mean for monetary policy, again was the culprit weighing on investors’ minds and account values. One consideration is that investors are now entering March and are faced with very negative sentiment. This could actually be bullish and may lead the major indexes on a wave upward.

The next scheduled FOMC meeting is March 21-22. By then, we will have seen another round of inflation numbers as CPI (March 14) and the PCE index (March 15) are both released during the same week, otherwise known as the ides of March. While the Fed is wrestling with stubborn inflation, it is keeping an eye on the strong labor markets. Although low unemployment is desirable, tight labor markets are helping to drive prices up. The Fed is looking to find a better balance.

Look Back

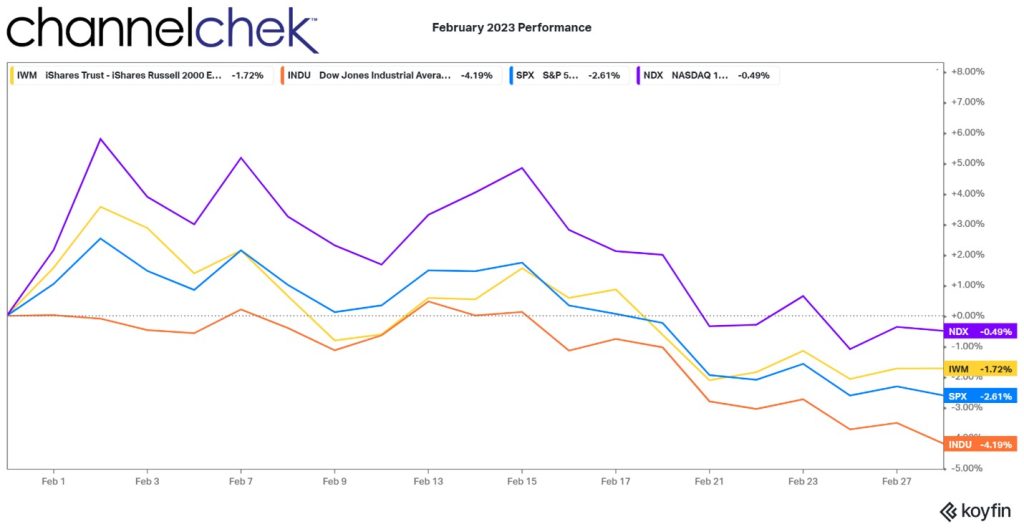

The three broad stock market indices (S&P 500, Nasdaq 100, and Russell 2000) are positive on the year, the Dow went negative on the 21st of February. The Nasdaq 100 and Russell 2000 have gained 9.70% and 8.22% respectively year-to-date, while the S&P is a positive 3.21% and the Dow Industrials is a negative 1.45%.

Each of the four closely watched indexes shown above began falling off as soon as January ended. It has only totalled a partial reversal, but the overall negative sentiment rose through February.

Viewing the indices from a year-to-date perspective, all but the Dow are well above their historical average pace.

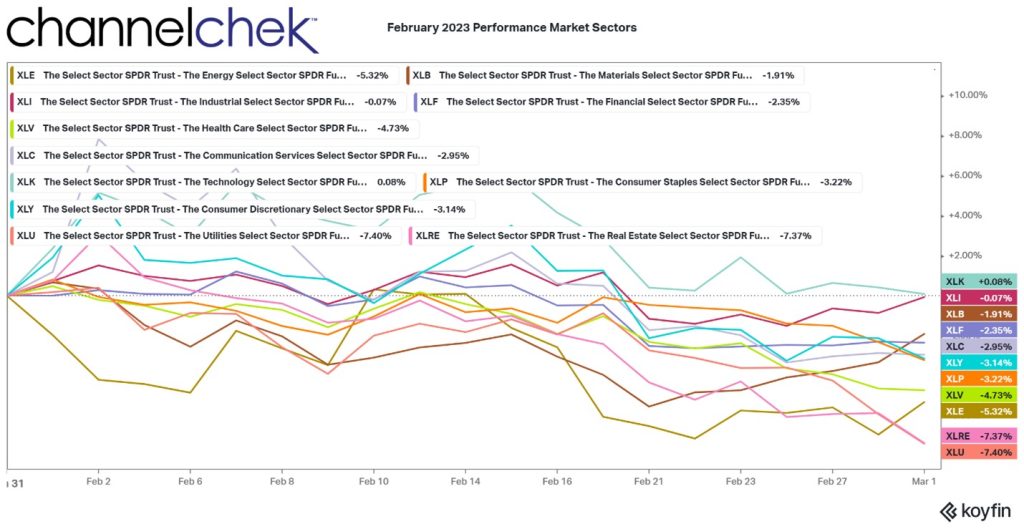

Market Sector Lookback

Of the 11 S&P market sectors (SPDRs) only one was in positive territory for the month. This is Technology (XLK) and was barely positive at .08%. That is followed by Industrials (XLI), which fell a mere .07%. This demonstrates the flaw in using the Dow 30 Industrials (declined 4.07%) which is not as broad of an index or a great gauge of stock market direction. The third top performer was Financials (XLF) which returned a negative 2.26%. Financial firms tend to benefit from higher yields, especially if the yield curev steepens, the curve currently has negative spreads out longer.

Of the worst performers are Utilities (XLU), down 7.45%. Many investors in utilities these stocks for dividend yield; as US government bonds pay more interest, they make utility stocks less attractive. Real Estate is also affected by higher rates as underlying assets (properties) decline and the attractiveness of its dividends diminish with high rates available elsewhere. The Energy sector (XLE) was the third worst. Energy is taking its lead from what is happening between Russia and the rest of Europe.

Looking Forward

Income and consumer spending have held strong in early 2023. This would seem to put off any chance of a recession beginning this quarter or next. Earnings reported for the fourth quarter have been mixed. Public companies are dealing with their own increased costs of doing business.

The Fed raising rates one, two, or three more times in 2023 is fully expected. What became less certain is whether they will continue to rely on 25bp increments or if another 50bp is on tap in March or beyond. The Fed began raising rates last March, a large impact has yet to be felt, and it is not expected to take a wait-and-see approach soon.

February’s small decline after a large January run-up is not unusual activity. In fact the short month has typically been one of the worst of the year for the U.S. stock market. Historically, the S&P 500 has performed better in March and April. How much better? Since 1928, the S&P 500 has averaged a 0.5% gain in March and a 1.4% gain in April.

Take-Away

The market was given a lot to think about in February. Inflation stopped trending down, earnings were not exciting, and participants had amassed better gains than they had in previous months. It was time for some to take some chips off the table and look for an opportunity to get back in.

March, which historically has been positive, will allow investors to see if the tick-up in inflation is a trend or an aberration and whether negative sentiment, with money on the sidelines, makes the current market more of a buy than a sell.

Managing Editor, Channelchek